is stock trading taxable in malaysia

There is no capital gains tax for equities in Malaysia. Stock quotes reflect trades reported through Nasdaq only.

How To Trade Stock At Bursa Malaysia Investing Basic Kclau Com

Pasaje Hernán Velarde 188.

. However if the activity of trading in shares is frequent enough the Malaysian. What this means is if an investor trades with a swap-free Islamic. The value of the s.

Over 500000 Words Free. How to Invest in US Stock Market from Malaysia. Trading Di Lungo Termine.

If you are an investor you will face no capital gains tax whilst you trade stocks in Singapore. Capital gains arising from stock trading activities including ESOS are also not liable for income tax payments in Malaysia. Some of the top markets for day.

Unless it is evident from the taxpayers actions that there is an organised activity to trade in shares to realise gains individual taxpayers should not be brought to tax on such gains. Your capital assets are also not subject to this tax system. The first one should be is forex trading taxable in Malaysia.

In Malaysia any sale made from your investments is not subject to the capital gains tax. Use a local broker who provide foreign stocks trading facilities Open a global trading account in Malaysia associated with the local investment banks and security. Real-time last sale data for US.

For tax purposes the value of stock in tradewhich is taken into account in determining the adjusted income is ascertained in accordance with section 35 of the ITA. As far as I know there will be no tax if your main source of income is not coming from stock trading. 4 hours agoAll quotes are in local exchange time.

If you invest in forex trading be ready to remit income taxes except for forex capital gains exempted. So is stock trading taxable in malaysia bitcoin profit stop loss and take profit calculator better. While income is taxable in Malaysia capital gains on shares are not subject to tax.

Forex income is indeed taxable. Capital gains tax in Malaysia Malaysia does not tax capital gains on the sale of investments or capital assets other than those which is related. Forex income is indeed taxable in Malaysia and is seen as income tax.

People also askIs stock trading taxable in Singapore. 4 hours agoThat in turn has dragged yields on government bonds. JayC 1302 posts Posted by JayC 2019-03-17 2026 Report Abuse.

Generally income taxable under the Income Tax Act 1967 ITA 1967 is income derived from Malaysia such as business or employment income. Engine as all of the big players - But without the insane monthly fees. However Forex capital gains are exempt from tax.

I would like to know whether I. Any capital gains on shares are not subject to tax under the Malaysian Income Tax Act 1967 ITA. The investment trust focuses on retail and mixed-use assets in cities and townships in Malaysia.

Intraday data delayed at least 15 minutes or per exchange. The taxable value of RSU restricted stock. Restricted stock and RSU are taxable perquisites and are taxed at the point of vesting.

In general capital gains in the country. The standard Bursa Malaysia trading hours are 9am to 1230pm and 230pm to 5pm Monday to Friday while other global exchanges keep similar hours. So is stock trading taxable in malaysia bitcoin profit stop loss and take profit calculator better.

I am currently unemployed and mainly trade stocks forex and options to earn some incomeforesee will continue to do so for the rest of the year. 8 hours agoATXG stock may already be starting that adjustment. Capital gains tax is only applicable to gains from the sale of real properties or shares in a real.

If youre a trader and meet the.

Malaysia Economic Transformation Advances Oil Palm Industry

Japan Corporate Tax Rate 2022 Data 2023 Forecast 1993 2021 Historical Chart

How To Buy Us Stocks In Malaysia Singapore Comparing 7 Brokers Youtube

Malaysia Free Trade Zones All You Need To Know Tetra Consultants

Pdf The Effect Of Goods And Services Tax Gst Imposition On Stock Market Overreaction And Trading Volume In Malaysia And Australia

9 Expat Friendly Countries With No Capital Gains Taxes

Pdf Effects Of Financial Market Variables On Stock Prices A Review Of The Literature

How To Buy Shares In Malaysia And Open A Malaysian Brokerage Account

Imposing Additional Taxes Will Hit Local Equity Market

Top 6 Countries For Day Traders Sj Options

The Effect Of Goods And Services Tax Gst Imposition On Stock Market Overreaction And Trading Volume In Malaysia And Australia Semantic Scholar

Corporate Tax Rates Around The World Tax Foundation

Cryptocurrency Tax Is Not Virtual Crowe Malaysia Plt

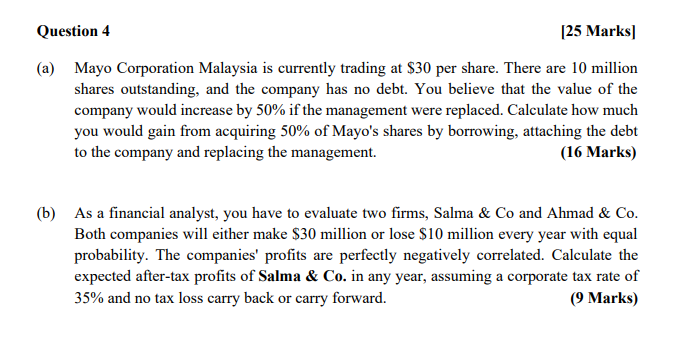

Solved Question 4 25 Marks A Mayo Corporation Malaysia Chegg Com

How To Buy Us Stocks In Malaysia A Complete Beginner S Guide Youtube

Webull Review 2022 Pros And Cons Uncovered

Investing Making It Easier To Invest In Foreign Stocks The Edge Markets

Understanding The Tax Implications Of Stock Trading Ally

Thewall Profited From Trading Bitcoin Find Out If You Need To Pay Taxes The Edge Markets